tax sheltered annuity calculator

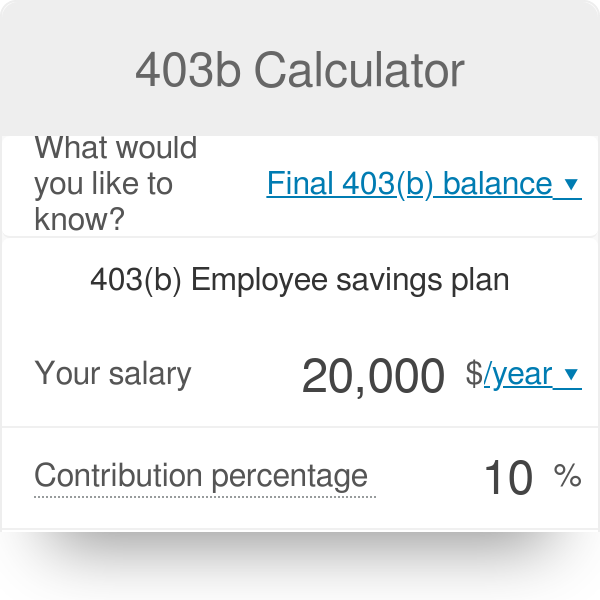

The terms tax-sheltered annuity and 403b are often used interchangeably. If you are a chaplain and your employer doesnt exclude contributions made to your 403 b account from.

Annuity Investment Calculator Investment Annuity Calculator

A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way.

. Compare Live Annuity Rates From Over 25 Top Rated Companies. Find a Dedicated Financial Advisor Now. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

We Offer Innovative Products For Retirement That Help You Keep Your Plans. You are only taxed on the. In 1958 section 403 b of the Internal Revenue Code was put in place to limit the amount that could be contributed to such.

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. If you withdraw money from your.

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Forgot password Forgot password Opens in new window.

Get a free bonus retirement guide. In this publication you will find information to help you do the. 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011.

Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they. Learn More on AARP.

In essence they were fully portable pensions. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. 13 Retirement Investment Blunders to Avoid.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. A tax-sheltered annuity plan gives employees. Ad Get The Most Income.

Ad Click here for some simple facts about paying RMDs and managing retirement withdrawals. The earnings are taxable over the life of the payments. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

If you are a self-employed minister you must report the total contributions. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. Tax Sheltered Annuity TSA Contribution Limit Formula Please click a link below for the year you would like to calculate contributions.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Its like a 401k but for public and non-profit institutions rather than private companies.

As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. A 403b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well.

Per IRS Publication 571 Tax-Sheltered Annuity Plans 403 b Plans page 4. Per IRS Publication 571 regarding Tax-Sheltered Annuity Plans 403 b Plans on page 4. The most common tax-sheltered investments.

Do Your Investments Align with Your Goals. Tax Sheltered Annuity Contributions. When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities.

Ad Our Income Annuity Calculator Can Help You Plan For The Future. Use our Annuity Income Calculator to help determine whether your essential expenses will be covered in retirement and discover how an annuity could provide additional guaranteed. Forgot user ID Forgot user ID Opens in new window.

It is also known as a 403 b retirement plan and. A 403b is also known as a tax-sheltered annuity TSA. This publication can help you better understand the tax rules that apply to your 403 b tax-sheltered annuity plan.

Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. IRC 403 b Tax-Sheltered Annuity Plans. An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per month.

A Fixed Annuity can provide a very secure tax-deferred investment. Earnings in annuities grow and compound tax.

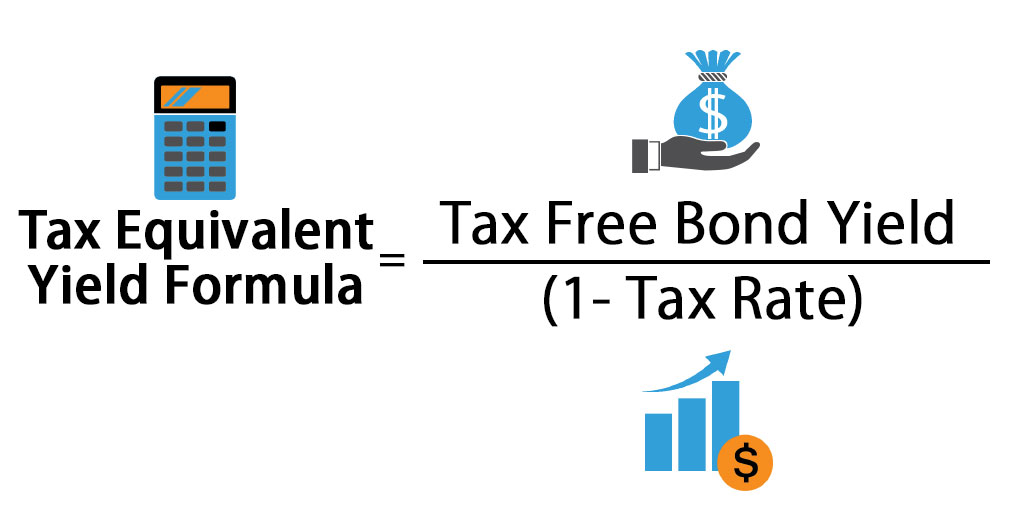

Tax Equivalent Yield Formula Calculator Excel Template

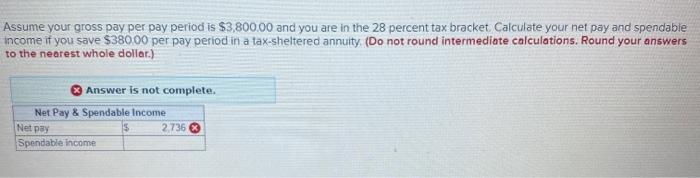

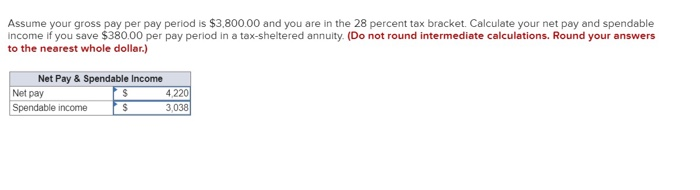

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

The Best Annuity Calculator 17 Retirement Planning Tools

What You Should Know About Tax Sheltered Annuities The Motley Fool

Obamacare Investment Tax Problem For High Income Earners

The Best Annuity Calculator 17 Retirement Planning Tools

The Tax Sheltered Annuity Tsa 403 B Plan

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Exclusion Ratio What It Is And How It Works

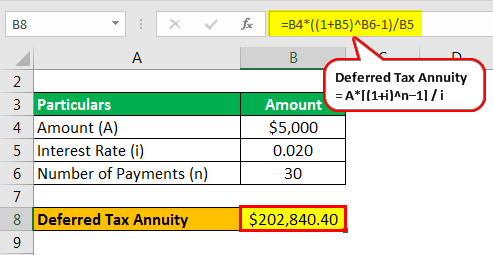

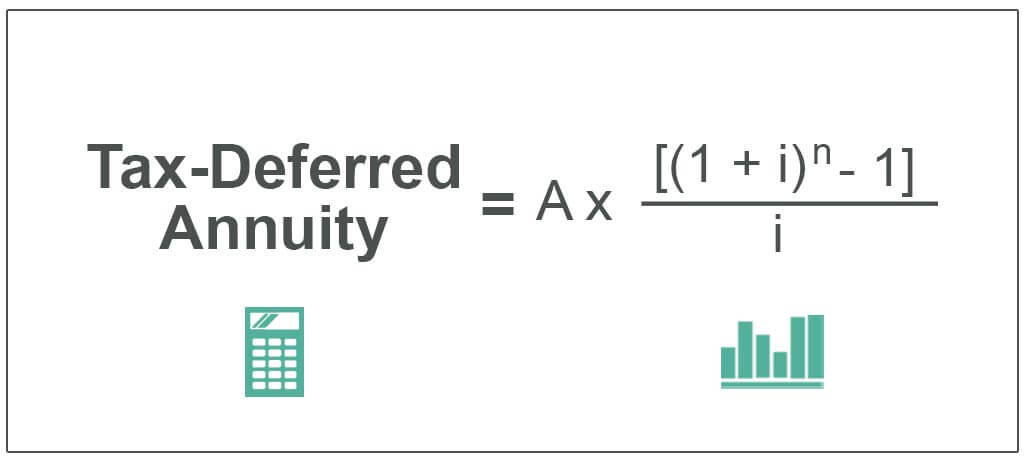

Tax Deferred Annuity Definition Formula Examples With Calculations

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

The Best Annuity Calculator 17 Retirement Planning Tools

Business And Finance Tax Information

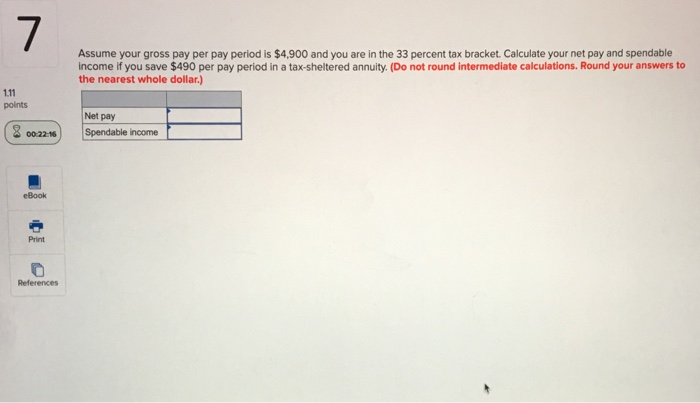

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com

Tax Deferred Annuity Definition Formula Examples With Calculations

Annuity Taxation How Various Annuities Are Taxed

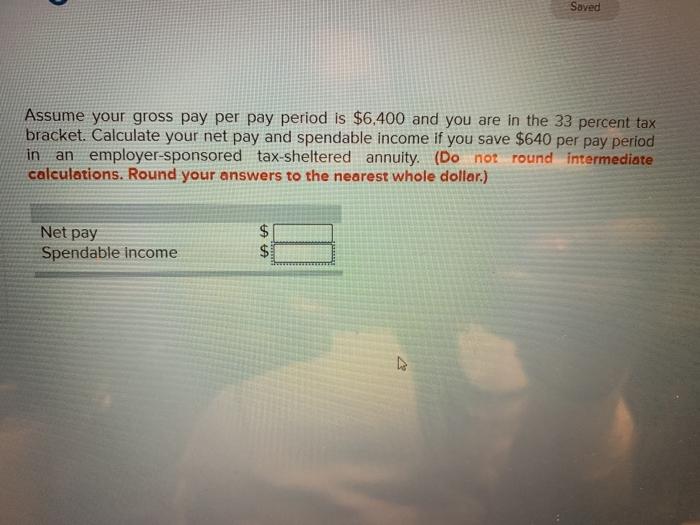

Solved Saved Assume Your Gross Pay Per Pay Period Is 6 400 Chegg Com

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite